Kathleen Finnegan

Home(818) 601-0056

Interesting Statistics Category

Your Summer Market Report Is Here

Well, it's true! California real estate is undoubtedly one of the best investments you can make. The market has proven the vitality and value of owning, buying, and or selling a home in California and even more specifically in or near Los Angeles! Below are the July 2018 market stats for real estate in LA County. If you have questions or would like even more detail on a specific area in your community, don't hesitate to give me a call... Continue Reading >

Well, it's true! California real estate is undoubtedly one of the best investments you can make. The market has proven the vitality and value of owning, buying, and or selling a home in California and even more specifically in or near Los Angeles! Below are the July 2018 market stats for real estate in LA County. If you have questions or would like even more detail on a specific area in your community, don't hesitate to give me a call... Continue Reading >

Smart Tax Options

Though you don’t have to rely on a tax professional to prepare your taxes, there are several systems that can serve as a virtual assistant for you. Online programs available can guide you through your business and personal taxes. Below is an outline of the benefits of three of the most popular programs that have the reputation for taking the stress out of the process.

TURBOTAX: Turbotax offers a variety of options for filers to enter their W-2's and 1099... Continue Reading >

Though you don’t have to rely on a tax professional to prepare your taxes, there are several systems that can serve as a virtual assistant for you. Online programs available can guide you through your business and personal taxes. Below is an outline of the benefits of three of the most popular programs that have the reputation for taking the stress out of the process.

TURBOTAX: Turbotax offers a variety of options for filers to enter their W-2's and 1099... Continue Reading >

Is Your Information Safe Online?

Technology has launched us all into a new era of information and access. Though extremely helpful, this new era requires a higher level of security, so that our platforms and personal information remains safe. Use the information below to add an additional layer of security when utilizing the internet.

Stay connected with real estate tips, updates, and events throughout Los Angeles and the San Fernando Valley area. With several listings, events, sold properties, and more to share, be sure to follow me on Facebook, Instagram,... Continue Reading >

Technology has launched us all into a new era of information and access. Though extremely helpful, this new era requires a higher level of security, so that our platforms and personal information remains safe. Use the information below to add an additional layer of security when utilizing the internet.

Stay connected with real estate tips, updates, and events throughout Los Angeles and the San Fernando Valley area. With several listings, events, sold properties, and more to share, be sure to follow me on Facebook, Instagram,... Continue Reading >

Why Understanding the Market Matters

Understanding the real estate market gives window into several areas necessary when picking where and when to buy or sale your home. Knowing and understanding the rise or fall of the market can position you to not only make a smarter choice when working with your realtor, but a more profitable one as well. Take a look at these two areas in which understanding the market really matters.

Gaining the full economic picture is one of the most valuable components... Continue Reading >

Understanding the real estate market gives window into several areas necessary when picking where and when to buy or sale your home. Knowing and understanding the rise or fall of the market can position you to not only make a smarter choice when working with your realtor, but a more profitable one as well. Take a look at these two areas in which understanding the market really matters.

Gaining the full economic picture is one of the most valuable components... Continue Reading >

Smart Simple Strategies for Saving in 2018

Saving is one of the top 5 new year's resolutions according to a survey by Neilson and continues to be a goal for many throughout the year. Achieving this goals takes a plan of action because though many desire to save, very few people are able to consistently save the amount necessary to reach their goals. Whether you are desiring to buy a new home, save for a child's tuition, plan a move, or build your 401K, effective saving habits... Continue Reading >

Saving is one of the top 5 new year's resolutions according to a survey by Neilson and continues to be a goal for many throughout the year. Achieving this goals takes a plan of action because though many desire to save, very few people are able to consistently save the amount necessary to reach their goals. Whether you are desiring to buy a new home, save for a child's tuition, plan a move, or build your 401K, effective saving habits... Continue Reading >

Winter Market Report

Let's take time to review some of the changes that have taken place and what that may mean for future home sellers and buyers. By tracking the data (seen below) found in LA County we can plan ahead, understand the current climate, and utilize the current benefits of buying and selling now.

As seen above, the median sale price has increased! Excellent news for sellers with a premium offering. Median price increases are especially positive for those found in the valley... Continue Reading >

Let's take time to review some of the changes that have taken place and what that may mean for future home sellers and buyers. By tracking the data (seen below) found in LA County we can plan ahead, understand the current climate, and utilize the current benefits of buying and selling now.

As seen above, the median sale price has increased! Excellent news for sellers with a premium offering. Median price increases are especially positive for those found in the valley... Continue Reading >

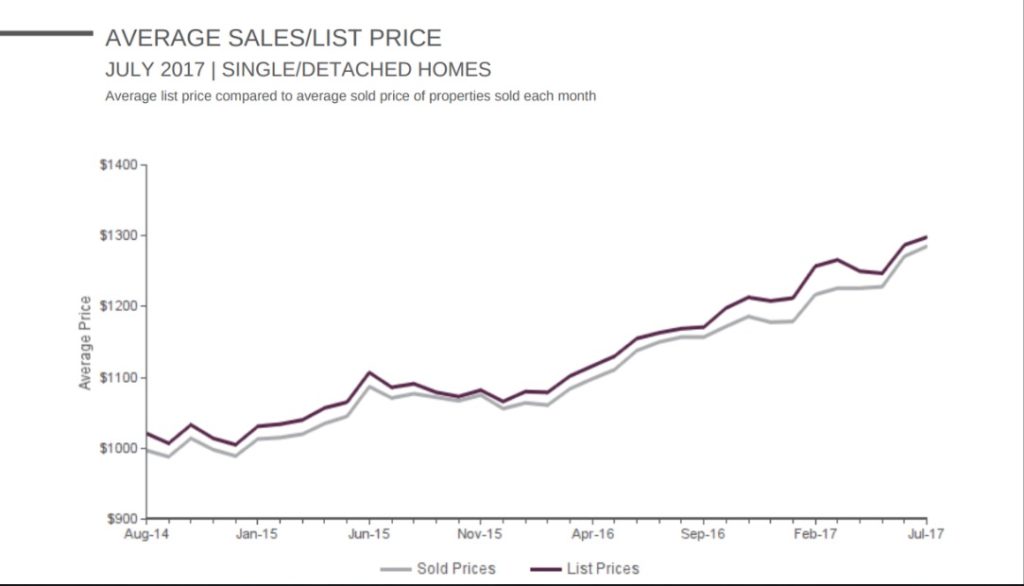

Your July Market Report

With the market constantly growing and shifting, it's a good idea to stay informed on what's happening in real estate within the communities around you here in Los Angeles County. Whether you or someone you know is looking to move this year or the next, understanding how your local area moves within price point and sales can be vital in taking the next right step. My team and I work to keep a close track on what's going on in... Continue Reading >

With the market constantly growing and shifting, it's a good idea to stay informed on what's happening in real estate within the communities around you here in Los Angeles County. Whether you or someone you know is looking to move this year or the next, understanding how your local area moves within price point and sales can be vital in taking the next right step. My team and I work to keep a close track on what's going on in... Continue Reading >

Know Your Market: Real Estate Market Report

Looking to move? Thinking of selling or buying? Our market report below shows detailed real estate stats to help you make the most informed decision for you or your family.

Have questions? Reach out to me directly here. Or call me at 818-601-0056,

And stay connected with me on social media for all real estate updates. Facebook, Instagram, Twitter.

Continue Reading >

Looking to move? Thinking of selling or buying? Our market report below shows detailed real estate stats to help you make the most informed decision for you or your family.

Have questions? Reach out to me directly here. Or call me at 818-601-0056,

And stay connected with me on social media for all real estate updates. Facebook, Instagram, Twitter.

Continue Reading >

Stunning Calabasas Home for Sale

This new Calabasas home is on the market, but won't last long. Its stunning staircase, interior decor, detailed landscaping, pool, four car garage, and lavish gardens, are truly exquisite. Found in the heart of Calabasas on Newcastle Lane, this home may be just the right fit for you or your family. Contact us today! Call 818.601.0056

[embedyt] http://www.youtube.com/watch?v=BSYkc4O8SgU[/embedyt]

Continue Reading >

This new Calabasas home is on the market, but won't last long. Its stunning staircase, interior decor, detailed landscaping, pool, four car garage, and lavish gardens, are truly exquisite. Found in the heart of Calabasas on Newcastle Lane, this home may be just the right fit for you or your family. Contact us today! Call 818.601.0056

[embedyt] http://www.youtube.com/watch?v=BSYkc4O8SgU[/embedyt]

Continue Reading >

Why Buying Now is Perfection

With this year predicted to be a great year for the housing market, you need a realtor you can trust, that has an amazing track record of excellence. Whether you are selling or buying a home, you have come to the right place at the right time. View the stats below that show the housing outlook for this year and contact us here or leave a comment. We'd love to hear from you!

Continue Reading >

With this year predicted to be a great year for the housing market, you need a realtor you can trust, that has an amazing track record of excellence. Whether you are selling or buying a home, you have come to the right place at the right time. View the stats below that show the housing outlook for this year and contact us here or leave a comment. We'd love to hear from you!

Continue Reading >

Kathleen Finnegan

23925 Park Sorrento

Calabasas, Ca 91302

#01193021

Office 818-876-3111

Cell 818-601-0056

Kathleen has been active in the Calabasas real estate market for over 20 years. Have a question?

Kathleen has been active in the Calabasas real estate market for over 20 years. Have a question?