Kathleen Finnegan

Home(818) 601-0056

Interesting Statistics Category

where are mortgage rates heading?

Mortgage rates will likely rise above 5 percent in 2014 and average 5.3 percent by the end of 2015, according to the Mortgage Bankers Association’s forecast. That would mark a big jump over where mortgage rates stand now. The MBA reported this week that the 30-year fixed-rate mortgage averaged 4.33 percent, the lowest average since June. The MBA expects that the Federal Reserve will decide to taper its $85-billion per month bond-purchasing program in early 2014 and end it altogether in September... Continue Reading >

mortgage rates roll back to July levels

Mortgage rates continue to fall, following the Federal Reserve’s decision to delay tapering its bond purchase program. The Federal Reserve announced last week that it would delay winding down its $85 billion per month bond purchasing program, which has helped to keep mortgage rates near record lows in recent years

“These low rates should somewhat offset the house price gains seen the last number of months and keep housing affordability elevated,” says Frank Nothaft, Freddie Mac’s chief economist.

The average rate on... Continue Reading >

Mortgage rates continue to fall, following the Federal Reserve’s decision to delay tapering its bond purchase program. The Federal Reserve announced last week that it would delay winding down its $85 billion per month bond purchasing program, which has helped to keep mortgage rates near record lows in recent years

“These low rates should somewhat offset the house price gains seen the last number of months and keep housing affordability elevated,” says Frank Nothaft, Freddie Mac’s chief economist.

The average rate on... Continue Reading >

Is now a good time for a mortgage?

Before you apply for a home loan, evaluate your personal finances. How much you earn versus how much you owe will likely determine how much a lender will let you borrow. Add Up Your Income First, determine your gross monthly income. This includes any regular and recurring income that you can document. If you can’t document the income, or if it doesn’t show up on your tax return, then you can’t list it to qualify for a loan. However, you can use... Continue Reading >

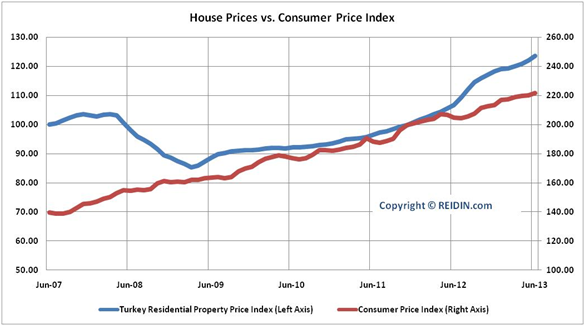

the big picture

Home prices were up sharply in June but the pace may be slowing, a widely watched housing index reported Tuesday.

June home prices were up 12.1% from a year earlier and all 20 cities in the index posted gains on a monthly basis, shows the S&P Case-Shiller 20-city index.

But only six cities saw prices rising faster in June compared to 10 in May.

With interest rates rising to almost 4.6%, "home buyers may be discouraged and sharp increases may be dampened," says... Continue Reading >

Home prices were up sharply in June but the pace may be slowing, a widely watched housing index reported Tuesday.

June home prices were up 12.1% from a year earlier and all 20 cities in the index posted gains on a monthly basis, shows the S&P Case-Shiller 20-city index.

But only six cities saw prices rising faster in June compared to 10 in May.

With interest rates rising to almost 4.6%, "home buyers may be discouraged and sharp increases may be dampened," says... Continue Reading >

moving forward

San Fernando Valley home prices surged again in June amid plunging foreclosure activity and tight inventory, according to two reports released Monday.

Last month, the median home price in the Valley increased 29.3 percent, to $505,000 from $390,500 a year ago, said the San Fernando Valley Economic Research Center at California State University, Northridge. It was the 12th consecutive month of year-over-year price increases.

Just since May, the median is up 1.2 percent from $499,000, and June was the first time the... Continue Reading >

San Fernando Valley home prices surged again in June amid plunging foreclosure activity and tight inventory, according to two reports released Monday.

Last month, the median home price in the Valley increased 29.3 percent, to $505,000 from $390,500 a year ago, said the San Fernando Valley Economic Research Center at California State University, Northridge. It was the 12th consecutive month of year-over-year price increases.

Just since May, the median is up 1.2 percent from $499,000, and June was the first time the... Continue Reading >

2013 california housing market

If the experts are correct, California´s housing market will stay the course in 2014, with sales and prices continuing to increase slowly and steadily as they have for two years.

Interest rates remain at historic lows and home prices are still relatively affordable. However, while it’s an excellent time to buy, it’s not a simple time to do so, as banks aren’t making credit easily available, and many of those who purchased their homes at inflated prices several years ago aren’t... Continue Reading >

If the experts are correct, California´s housing market will stay the course in 2014, with sales and prices continuing to increase slowly and steadily as they have for two years.

Interest rates remain at historic lows and home prices are still relatively affordable. However, while it’s an excellent time to buy, it’s not a simple time to do so, as banks aren’t making credit easily available, and many of those who purchased their homes at inflated prices several years ago aren’t... Continue Reading >

Kathleen Finnegan

23925 Park Sorrento

Calabasas, Ca 91302

#01193021

Office 818-876-3111

Cell 818-601-0056

Kathleen has been active in the Calabasas real estate market for over 20 years. Have a question?

Kathleen has been active in the Calabasas real estate market for over 20 years. Have a question?